Welcome back readers. I hope you enjoyed my 1st post on Uniswap and the UNI token. I received over a 100 subscribers from just my first post—this wildly exceeded my expectations. I truly appreciate your engagement and readership. I will strive to continue delivering you valuable content.

On to business. Today, I’d like to explore Aave, a decentralized lending & borrowing protocol on the Ethereum Blockchain.

A note: Aave refers to the name of the protocol and AAVE refers to the name of the token.

TL;DR: The Aave Protocol is the #1 borrowing & lending protocol today. However, the Tokenomics of the AAVE token are less rosy. There is a 2-tier reward system, with different rewards & risks if you stake your AAVE or not. Furthermore, there is large downside tail risk in a black swan sell-off event. I advise potential AAVE token buyers to have a clear thesis as to their preferred risk & return profile and their projections for Aave protocol volume after incentives end.

This post is quite long, but that’s because the Aave protocol’s features and risk management methodologies are quite extensive.

I first explore how depositing & borrowing works.

I move on to Aave’s success and compare it to other protocols before moving onto the AAVE Token, which covers its uses and Tokenomics.

Understanding the Aave Protocol

As a lending protocol, users can use Aave to deposit money and earn interest or borrow money and pay for doing so.

Explaining Depositing & Lending

To earn interest, all a user has to do is deposit assets into Aave. They then automatically earn interest in the currency that they deposited.

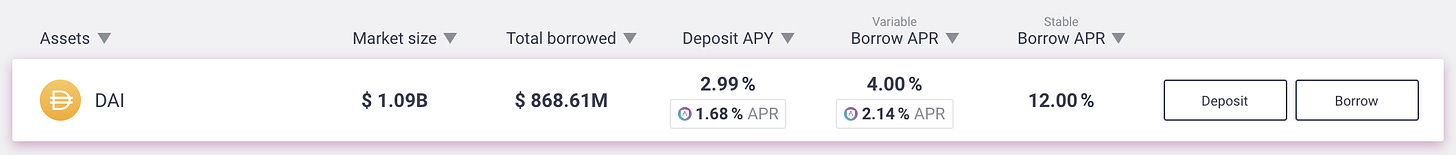

For example, in the above image, you can see that the Deposit APY is 2.99%. This means if you put 100 DAI in and hold it for 1 year, you can withdraw 102.99 DAI, assuming the interest rate stays the same. However, as we’ll see, stable interest rates are a large assumption.

Now, in order to borrow, you have to have some assets deposited. Aave operates as an over-collateralized lender. This is a fancy way of saying they make sure that the assets you use to borrow against, such as Ether, are worth more more than the assets you borrow, such as DAI.

A classic example of over-collateralized loans is mortgages, if you want to buy a $500,000 home, they generally ask you to give them at least a 20% down payment, or $100,000. Now you’ve borrowed $400,000 but the lender has collateral worth $500,000.

If you were to borrow DAI, you’d be paying a 4.00% APR, in the same DAI currency, meaning if you borrowed a 100 DAI, after 1 year, the debt would accrue to 104 DAI, assuming the interest rate stays the same.

What determines Interest Rates?

Aave Borrow Interest Rates are set by a function with inputs falling under 2 categories of variables:

Governance-Set Variables

Market-Based Utilization

Governance-Set Variables

There’s 4 variables that Aave governance sets for each asset:

Optimal Utilization Rate: For example, if there is $100 million DAI deposited in a pool and the Optimal Utilization Rate was 80%, the Optimal Amount would be $80 million.

Base Rate: The base rate is how much it costs to borrow when the utilization is 0.

Slope 1: This is the rate of change of the interest rate up to the optimal utilization rate.

Slope 2: This is the rate of change of the interest rate past the optimal utilization rate up to 100% of the pool being borrowed.

Market-based Utilization

This is simply calculating how much of the current pool is currently being borrowed.

Re-using an earlier example, we can see that the utilization rate is:

$868.61M borrowed / $1.09B deposited ≈ 80%A Few Examples

Let’s look up the governance variables for DAI.1

The base rate is 0% and the Slope 1 is 4% so the interest rate at Optimal Utilization, which is 80%, should be 4% APR. That’s exactly what we saw in our live example.

Now, what if Utilization was 70%?

We’re 7/8 of the way to optimal utilization so:

Interest Rate = 7/8 * (4%) + 0% = 3.5%What if Utilization was 90%?

Interest Rate = 1/2 * (75%) + 4% = 41.5%Wow, interest rate skyrockets really quickly past the optimal utilization rate! This is an incentive for borrowers to quickly close out their positions to bring the utilization rate back to the optimal rate.

Here’s the above in a graph form.

Stable Borrow Rates

Now, as you can see, variable borrow rates can become quite risky and require constant monitoring. If one borrows anywhere near optimal utilization rate, some new borrowers could quickly come in and raise the cost of borrowing for everyone.

Thus, Aave offers a stable borrow rate feature. Here, you pay a higher up-front rate than the variable rate, but indefinitely lock in your borrow rate until you close out your loan or if a few other conditions are met.2

Deposit Rates

We had to cover the borrowing rates before we could get to the deposit rates. Why? Because the interest paid by borrowers is split among the Aave protocol and depositors.

There is a reserve factor, set by Aave governance for each asset, that determines how much of the interest rate paid is taken by the Aave protocol and ends up in the Aave treasury.3 This ranges from 0-35% but is generally in the 10-20% range. The remaining portion is split among depositors.

This reserve factor is based on the riskiness of the asset and is held to cover losses. Where do losses come from if Aave is an over-collateralized lender? Well, crypto is extremely volatile and losses can occur rapidly.

Collateralization & Liquidation

Along with the reserve factor, Aave governance sets a few other variables for collateralization and liquidation:4

Collateralization Available? This is a binary yes/no and simply determines whether this asset can even be used to borrow against or not.

Loan to Value (LTV): What % of the deposited asset’s value can be borrowed up to? An asset with an LTV of 80% means you can borrow up to $80 if you deposit $100.

Liquidation Threshold: Past this LTV, your borrowing is liquidated. So if there is a liquidation threshold of 75%, if your LTV exceeds this, you can be liquidated at any time. If you had $100 worth of WBTC and your borrowing exceeds $75, it could be liquidated anytime by someone repaying the borrowed asset.

Liquidation Bonus: Liquidation is done manually by a liquidator, not the protocol. The protocol simply determines eligibility. To incentivize liquidation, liquidators are paid a bonus %. In the above example, after the borrowing was repaid by the liquidator, say it was a flat $75, if there was a 10% liquidation bonus, $7.5 extra would go to the liquidator and the original borrower could still claim the remaining $17.5 worth of WBTC.

Yield Farming

Returning to this image, note those APRs below the 2.99% Deposit APY and 4.00% Variable Borrow APR we discussed above.

These are a part of what the crypto-space refers to as yield farming.

To incentivize use of a protocol/feature, it is common for protocols to give rewards for usage in the protocol’s native token. In this case, if one was to borrow DAI and receive 2.99% APY in DAI, they would receive another 1.68% APR in the AAVE token.

This will be quite important in the analysis of the Tokenomics.

Flash Loan Borrowing

Flash loans are a unique crypto-enabled loan type. Essentially, a user can borrow any amount available on Aave with no collateral as long as the loan is repaid within the same blockchain transaction. This is complicated, so here’s an explainer that goes in-depth.

Aave charges 0.09% on the amount borrowed and 30% is taken by the protocol and put in the treasury while the remaining 70% is given to the depositors of the asset.

How successful is Aave?

Aave has been a #2 in the over-collateralized lending space on Ethereum compared to Compound until recently. Now it’s caught up when measured by total assets deposited.

However, the above chart only looks at the amount being lent on the Ethereum Blockchain. Aave has recently launched on Polygon. This is another Layer 1 Blockchain, meaning it is a Blockchain with its own security mechanism and its value is not secured by Ethereum. However, the Polygon developers have a friendly relationship with Ethereum and have aligned themselves to Ethereum. There is a bridge between the two and DeFi protocols can easily be deployed on Polygon, where they can be run much cheaper, with transaction costs measured in pennies instead of $10+ as commonly found on Ethereum.

Aave’s Polygon launch has increased assets deposited volume by over 50%.

While Compound & Aave are tied on Ethereum, at around $12B each, Aave has nearly an extra $8B on Polygon.

This is great, but the scaling wars have just started. I’d be skeptical of giving Aave the advantage on this front until we start some seeing more Layer 2 scaling solutions, such as Arbitrum and Optimism, and then examining how Compound and other competitors responds.

Yield Farming Relevance

Now, if you think back to the yield farming section, you might think that Aave is only tying despite giving out large incentives. However, Compound also has a generous yield farming program. Thus, it is not as relevant in a comparison between competitors, but it will be relevant later on in the Tokenomics.

What about other Lenders?

There are several other large lending protocols.

Some such as Maker and Liquity allow users to deposit assets and the protocol mints synthetic stablecoins that users can then borrow, (assets pegged to a currency, almost always the dollar).

Since these coins are minted by the protocol itself, they have the freedom to charge an arbitrary interest rate, whereas protocols like Aave and Compound charge via a market mechanism as users borrow assets supplied by other users, not synthetic assets minted by a protocol.

However, these other lending protocols have a downside which is that although they can charge lower rates, they do not offer depositors an interest rate. Thus, they cannot attract users who only want to deposit assets & earn interest.

Aave is currently the #1 Lending & Borrowing protocol although there’s stiff competition and its reign at the top is not assured by any means!

Understanding the Aave Token (AAVE)

Let’s start looking at the AAVE Token.

Aave was originally called ETHLend before rebranding themselves. They transitioned the LEND token to AAVE at a ratio of 100 LEND : 1 AAVE.

At the time of the transition, the total supply of AAVE was 16M, of which 13M was redeemable by LEND holders and the remaining 3M was put in the Aave Treasury, controllable by AAVE holders.

Aave Token Uses

Governance

AAVE holders have the right to vote on various governance protocols such as modifying risk management parameters highlighted above or setting incentive distribution policies for protocol growth.

Ownership of DAO Treasury

Through governance, AAVE holders can vote on how to use the treasury. Currently, it is filled via accumulation of the reserve factor discussed above and flash loan fees.

There is currently about $5M worth of assets in the treasury.

Staking AAVE

AAVE can be held by itself, or staked through the Aave protocol.

Staking AAVE means you volunteer your AAVE as deposit insurance. Currently, up to 30% of your staked AAVE can be taken by the protocol and sold off if there are not enough assets to cover debt after a liquidation.

However, in return, staked AAVE holders collectively receive 550 AAVE per day. Thus, AAVE holders who choose to take extra risk earn some AAVE.

AAVE Revenue Sources

Let’s look through all the ways the protocol makes money and what % the token can take.

Origination Fees

Each loan has a 0.0000001% origination fee. This is so small as to be useless. Furthermore, even though this variable could be changed, other competitors don’t charge meaningful origination fees either, so it is unlikely AAVE holders could increase this while being competitive.

I’m going to calculate this as bringing in no revenue.

Flash Loan Fees

30% of the 0.09% is claimed by the protocol. So far, about $5M has been earned However, I do not think this can be a large and meaningful revenue stream in the future for a few reasons:

Other protocols can implement this

Already, dYdX offers near-zero cost flash loans.

Flash loans are not a simple feature that everyone utilizes. They are leveraged by sophisticated users who must code them to utilize them. They are likely to be aware of competitor’s pricing and resist higher pricing.

Thus, we can likely estimate this at up to $25M per year, which is a generous estimate given the above factors.

Reserve Factor

This varies from 10-35% but is 10-20% for most of the heavily borrowed assets. They’ve already accrued over $5M here and this is the main way AAVE can generate extra money.

Currently, about $20B is deposited in the AAVE platform. Mostly stable-coins are borrowed. If we estimate about 50% can be borrowed at any one time, about $10B is eligible to earn fees. A 5% interest rate and 10% reserve factor yields about $50M per year accrued.

This definitely has large room to grow as AAVE can gather more assets to lend out, potentially raise the reserve factor (although this could hurt them competitively), and interest rates may raise in the future.

However, this is also being artificially boosted by liquidity incentive programs which I cover below in the “AAVE Emissions” section.

Total Revenue

Currently, we can optimistically say AAVE holders are entitled to about $75M annually in revenue. However, AAVE holders also face costs.

AAVE Costs

The main costs faced are from lending losses & emissions.

Lending Losses

If deposited assets are not enough to cover a user’s debt after they are liquidated, the protocol takes up to 30% of the staked AAVE and sells it off. If this is not enough to cover the shortfall, the protocol will generate new AAVE to auction off and cover the shortfall.

Calculating the expected loss of a tail risk event is nearly impossible. Suffice it to say, AAVE has not had meaningful losses here even when we’ve seen 30%+ drops within 24 hours and 60-80% drops within a week.

The automated liquidation is quite powerful and robust due to it being on-chain.

AAVE Emissions

I earlier mentioned 550 AAVE/day are being given out to AAVE stakers.

There is also a 550 AAVE/day incentive for users who provide AAVE/Eth liquidity through the Balancer DEX.

Aave governance also voted to give out 2200 AAVE/day in liquidity incentives for borrowers & lenders. Split across all v2 pools, 50% goes to borrower and 50% goes to lenders. This was proposed as a test to examine rewards will benefit the ecosystem.

It is currently set to expire on July 15th at which point the results will be examined and the community will decide whether to extend it or let it end.

These are large costs, and at AAVEs current $330 price, the 1100 AAVE/day equals a ~$130M cost although this will be turned off at some point in the future. I choose not to include the 2200 AAVE/day as this is an explicit pilot program, but buyers should definitely follow governance closely to see if this is extended.

Total Costs

Currently, AAVE holders, even staked or unstaked, face dilution pressure from a tail risk event (although lower risk for unstaked holders), and large ongoing dilution from on-going incentives for AAVE stakers and liquidity providers.

Thoughts on Tokenomics

Aave is a great protocol and the #1 depositing & borrowing protocol on DeFi right now.

However, the tokenomics for AAVE paint a less rosy picture. The current outstanding valuation is about ~$4B with a possible yearly revenue of $75M but with possible large downside costs and current heavy dilution.

I view AAVE as a very uncertain play and would advise buyers to have their buying thesis incorporate answers for:

How much % can AAVE take in the reserve factor over time?

What does AAVE market share & volume look like after incentives decrease/end?

How bad will a tail risk event be at different market sizes? If Aave is the largest protocol by far and has a shortfall, trying to cover this shortfall could be very difficult.

Am I going to stake and take more risk or will I simply hold and be diluted more while still exposing myself to tail risk?

Given that I, as a token holder, am so exposed to lending risk, do I plan to be an active governance participant in deciding various risk parameters or am I comfortable enough with governance and trust the process?

I would love to hear your thoughts & suggestions.

You can find me on Twitter @AishvarR or reach out to me at raishvar@gmail.com.

The stable loan rate can be rebalanced if utilization rate crosses 95% and the weighted average of all borrow rates exceeds 25%.

Amazing content! I would love to understand the tokenomics of MKR and MakerDAO. The episode of Pomp podcast with Felix Hartmann gave me some great insights about how the tokenomics determines how token is able to accrue value

Great write up, thank you!